Can You Send Money From Paypal To Cash App

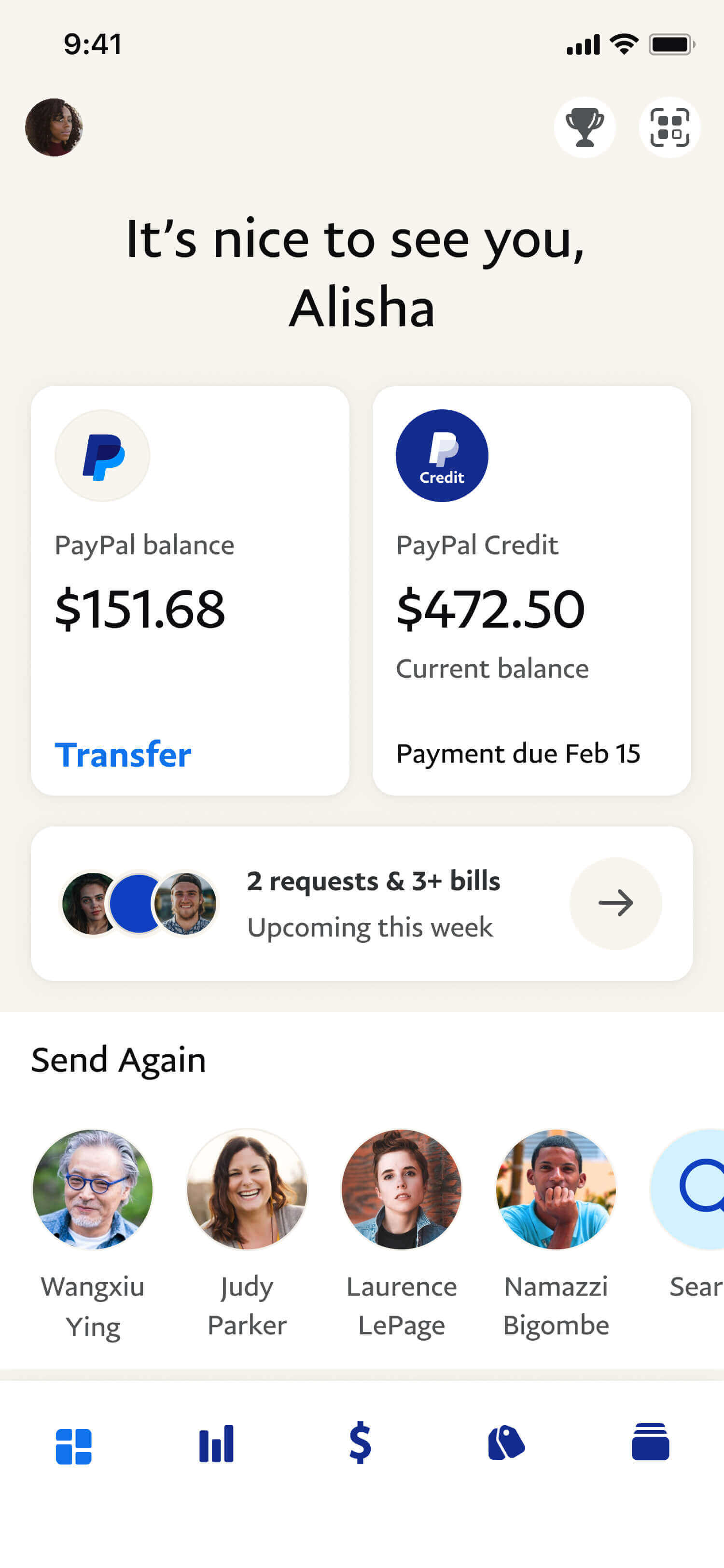

Life just got more flexible

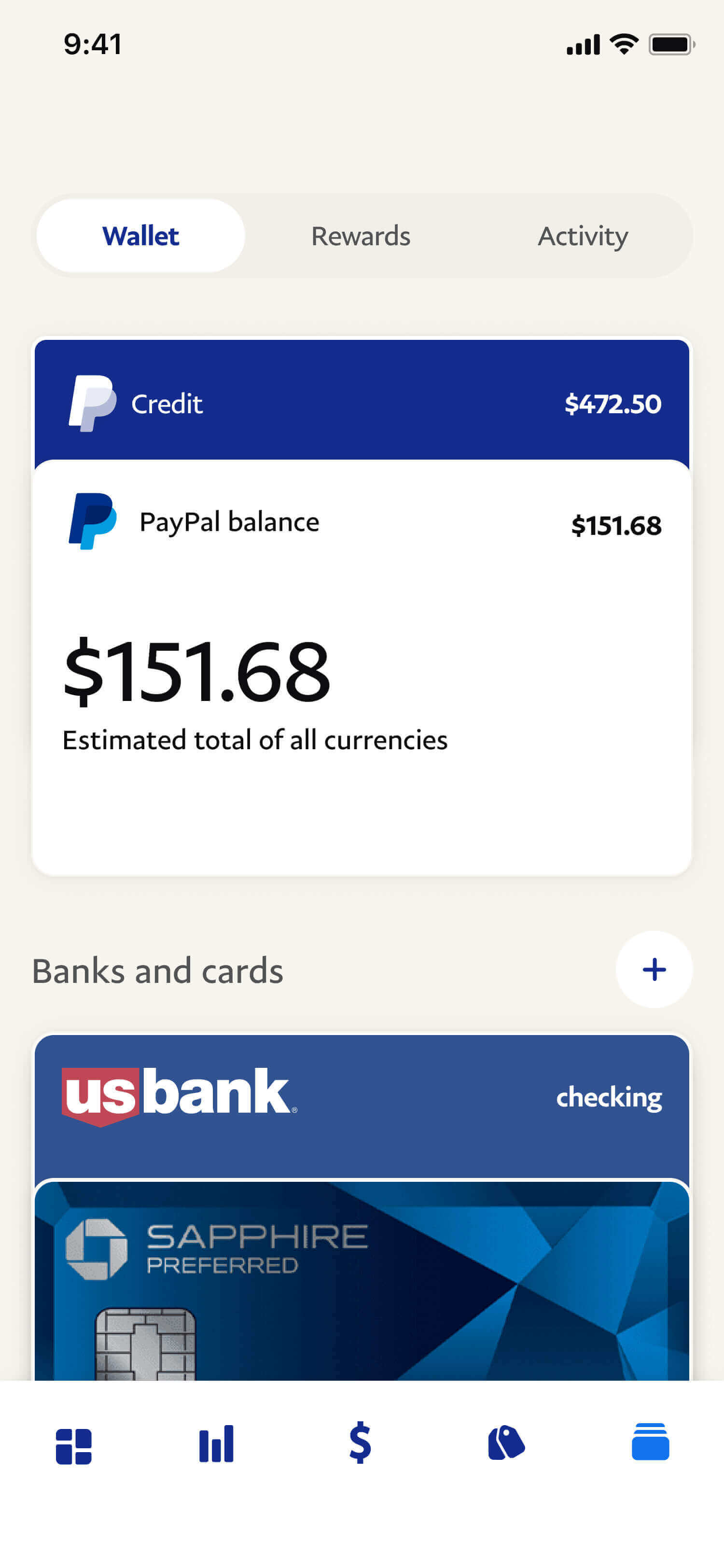

Discover how our reimagined app gives you more ways to PayPal.

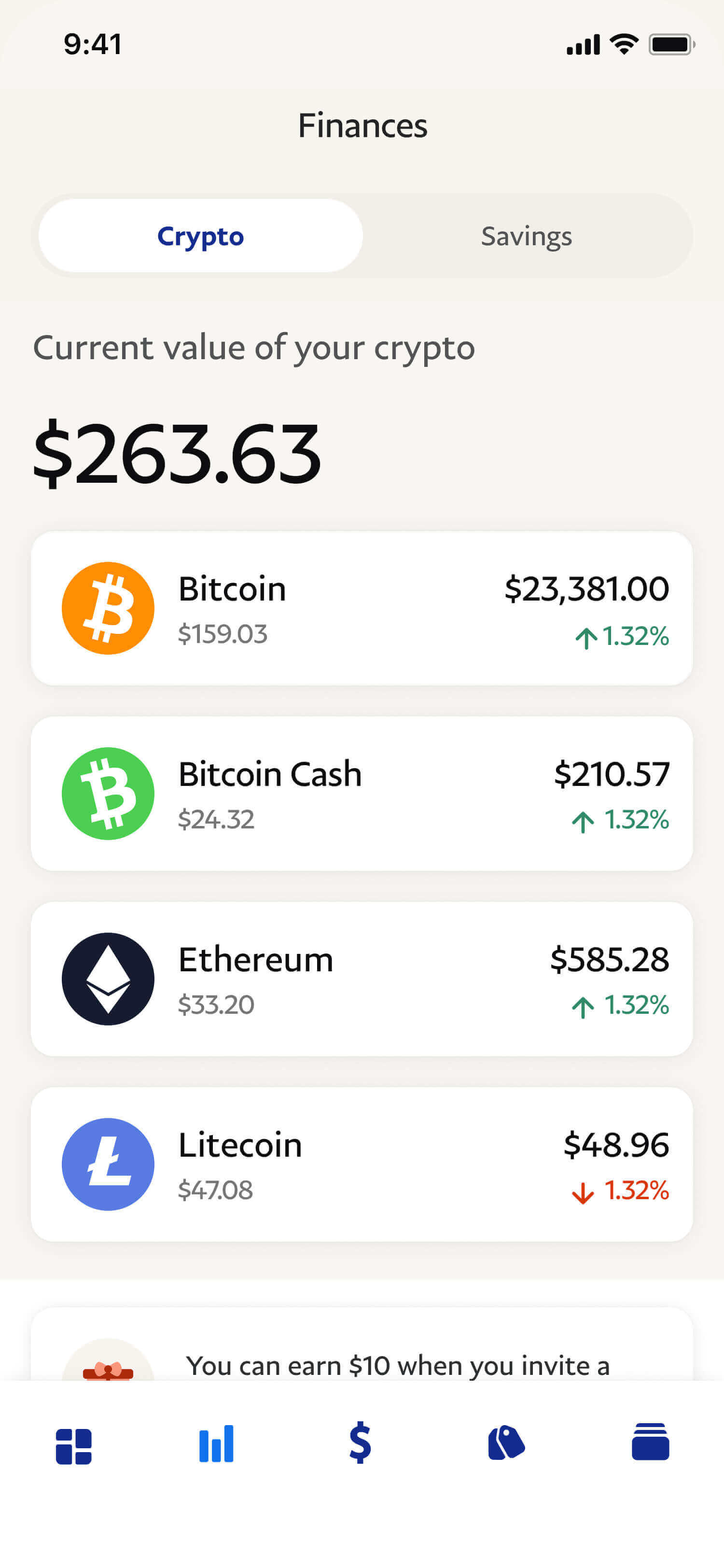

Buy, sell, and hold crypto

Conveniently explore cryptocurrencies with confidence in the new PayPal app.1

Get into crypto

Get paid before payday

Get paychecks and government payments automatically transferred up to 2 days early.2

More about Direct Deposit

Pay your bills in one place

Manage your subscriptions and household bills, all from one place.

Pay bills with PayPal

Coming soon

Earn interest and watch your money grow

With 0.40% APY, earn money as you set different savings goals.3

More about PayPal Savings

Check out with crypto

Use Bitcoin, Ethereum, Litecoin, or Bitcoin Cash when you pay with PayPal.1

Do more with crypto

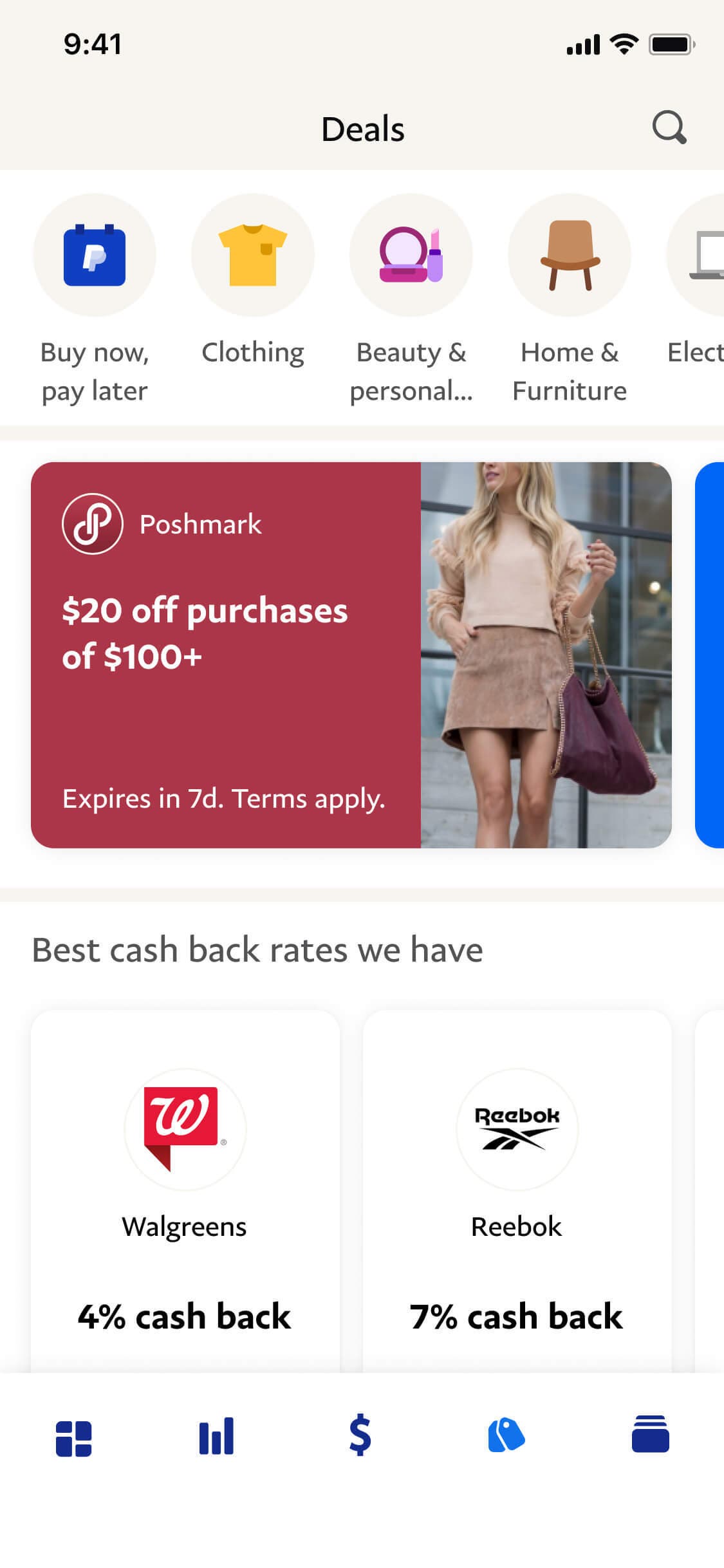

Buy now, pay later with Pay in 4

Make 4 interest-free payments at millions of online retailers with no late fees.5

Learn about Pay in 4

Earn cash back

Shop in the app, earn cash back on eligible items, and use it to make future purchases.6

About shopping in the app

Exclusive deals from PayPal

Get deals and new offers at some of your favorite stores when you shop in the app.

Discover deals

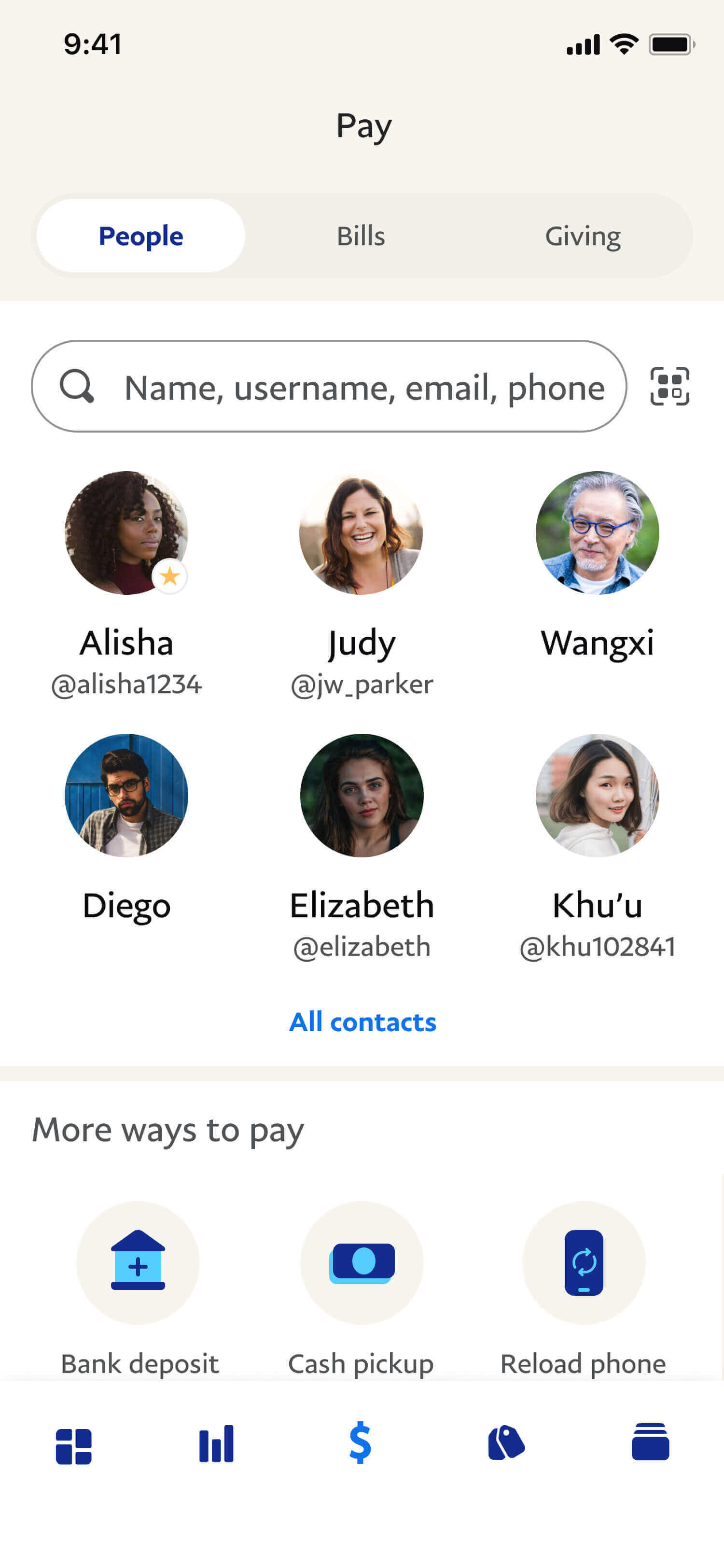

Send money abroad

Deposit directly into bank accounts, or send for pickup or delivery in 130+ countries with our Xoom service.8

Send money globally

Support your community

Make a difference and donate to support causes you care about.9

Give through the app

-

Pay bills and manage balances

-

Send money to friends and family

-

Get exclusive PayPal deals

-

Manage your ways to pay and receipts

Join over 400 million PayPal users

Easily and securely spend, send, and manage your transactions—all in one place.

Experience the new way to PayPal

Download the app on your phone or sign up for free online.

1 PayPal Balance account required. When you buy or sell cryptocurrency, including when you check out with crypto, we will disclose an exchange rate and any fees you will be charged for that transaction. The exchange rate includes a spread that PayPal earns on each purchase and sale. See cryptocurrency fees.

Buying and selling cryptocurrency is subject to a number of risks and may result in significant losses. Please see our disclosure here for more details. PayPal does not make any recommendations regarding buying or selling cryptocurrency. Consider seeking advice from your financial and tax advisor. All custody of and buying and selling in cryptocurrency is performed for PayPal by its licensed service provider, Paxos Trust Company, LLC. Buying, selling, and holding cryptocurrencies is not regulated in many states, including the State of California. PayPal, Inc. is licensed to engage in virtual currency business activity by the New York State Department of Financial Services. Buying, selling, and holding cryptocurrency with PayPal is not available in Hawaii and where prohibited by law.

2 Direct Deposit is subject to the payor's support of this feature. Funds deposited via Direct Deposit will generally be available on the day we receive the funds transfer. You may review activity on your periodic statements or transaction history on www.PayPal.com, or call Customer Service at 1-888-221-1161 to verify receipt. We reserve the right to accept, reject, or limit transfers via Direct Deposit in our sole discretion. If you wish to cancel Direct Deposits, you must contact your employer. PayPal does not charge any fee to set up or maintain Direct Deposit. Refer to your PayPal User Agreement for complete Direct Deposit details. Once it's set up, Direct Deposit usually takes two (2) pay cycles to begin but can vary across employers. Please check with your employer for specific timing.

New Direct Deposit enrollees will be eligible for early access, subject to the terms and conditions. The early access feature will be made available to all eligible Direct Deposit customers in the coming months. Early access can allow a user to access their funds up to 2 days early. Early access to funds depends on when we get payment instructions from the payor (your employer or government agency). When we get funds before the scheduled payment date, your money can be made available up to 2 days sooner than scheduled. Availability and timing can vary based on the payor and when we get payment instructions. Once the funds are received, they will be deposited directly into your PayPal balance.

3 As of September 2021, the annual percentage yield (APY) for PayPal Savings is anticipated to be 0.40% at launch. This is a variable rate and can change at any time, including after the account is opened. National average source: FDIC National Rates and Rate Caps as of August 16, 2021.

4 Pay with Rewards will be available for eligible credit cards on eligible purchases or can be donated to support a charitable cause with PayPal Giving Fund. All reward redemptions are subject to your issuer's reward program terms. To learn more about Pay with Rewards, see terms and conditions.

5 Pay in 4 is available to consumers upon approval for purchases of $30 - $1500. Pay in 4 is not currently available to residents of New Mexico, North Dakota, Missouri, South Dakota, Wisconsin, Nevada, Rhode Island, or any U.S. Territories. Loans to California residents are made or arranged pursuant to a California Finance Lenders Law License. PayPal, Inc. is a Georgia Installment Lender Licensee, NMLS #910457. For purchases made with Pay in 4 on or before September 30, 2021, late fees may apply for missed payments depending on your state of residency. When applying, a soft credit check may be needed, but will not affect your credit score. You must be of legal age in your U.S. state of residence to use Pay in 4. Offer availability depends on the merchant and also may not be available for certain recurring, subscription services. Offers are not pre-approved offers or firm offers of credit.

6 Cash back terms and conditions apply.

7 An account with PayPal is required to send and receive money.

8 Fees and limitations apply. In addition to the transaction fees, Xoom also makes money when it changes your US dollars into a different currency. No PayPal or Xoom account necessary.

9 PayPal covers all transaction fees when donating to the PayPal Giving Fund, a 501(c)(3) charity, subject to its terms. Donations can take up to 45 days to get to your chosen charity. It's rare, but if we can't send your money to this charity, we'll ask you to recommend another. If we can't reach you, we'll send it to a similar charity and keep you updated. Your donation is typically tax-deductible in the US. When giving through the Generosity Network, there are transaction fees for all non-charity fundraisers.

All screen images shown are for illustrative purposes only. Actual experience will be based on account activity.

Can You Send Money From Paypal To Cash App

Source: https://www.paypal.com/us/digital-wallet

Posted by: pearsonprooroo.blogspot.com

0 Response to "Can You Send Money From Paypal To Cash App"

Post a Comment